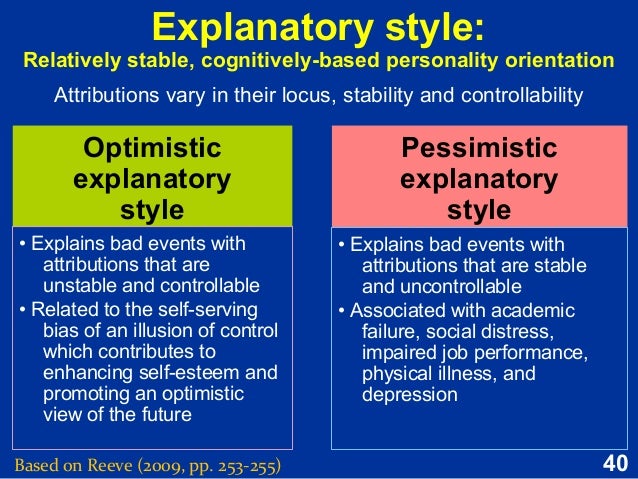

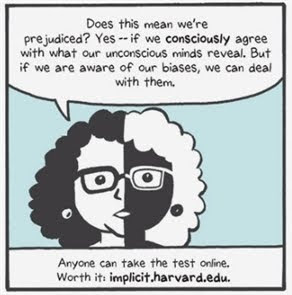

Stated more explicitly, many biases are known as ‘unconscious biases’. The important thing about biases is that, although we all have them, not everyone functions at the same level of self-awareness. Basically, optimism bias is simply good for business. Since advisors and their firms always want more money to manage, it would be counterproductive to get existing clients to pump the brakes and nearly impossible to recruit new clients while taking a more sanguine stance. Telling people to be cautious is not conducive to getting them to send you money. Part of why advisors are optimistic is that that’s what their industry expects of them. The second explanation is a little less innocuous. Most advisors come by their optimism naturally and honestly. It is a micro-level personality trait that is prevalent in the industry and it serves most advisors and most of their clients quite well. It has often been said that one of the most critical roles an advisor can play is one of behavioural coach – a person who can get you to do what you need to do to be successful, especially if you natural tendency is to do something else. Advisors are naturally optimistic people who play an important role in keeping people calm and focused on the long term. There are two reasons for this: the inherent personality types of advisors and the imbedded value propositions and pre-dispositions of the financial advice business. Whatever it is that advisors OUGHT TO do, it is often not what they ACTUALLY do. Aren’t fiduciaries supposed to be responsible stewards of their clients’ lifelong capital? Aren’t there at least some instances where caution and care are warranted as default behaviours? As far as I can tell, this is no place to discuss normative behaviour. Despite this, most financial advisors have an approach that is ‘all optimism all the time’ – prevailing circumstances be damned. They’re supposed to be responsible risk managers. Financial advisors are supposed to help navigate uncertain environments. I also didn’t see requisite caution prior to the dot.com bubble at the turn of the millennium and I didn’t see it before the Global Financial Crisis of 2007- 2009. As I write this in late April 2021, I confess that I don’t just see it. However, when valuations become stretched as they most certainly are now, that bullishness ought to give way to a more careful and cautious approach. There’s nothing wrong with bullishness when times are favourable or even normal. Some readers might be old enough to remember the old Merrill Lynch commercials: “We’re bullish on America”. In my line of work, the glass is almost perpetually half full. The generic affliction of overconfidence can easily give way to the more insidious affliction of optimism bias in the financial advice business. But what if the next draw down is not only severe, but also prolonged? Then what? If things generally work out – and let’s face it – the bear markets of our generation have not only been few and far between, they have also been relatively short-lived, then people will be fine. The general problem is one of overconfidence, an affliction that many people in general – and financial advisors in particular – suffer from. It remains a metaphysical certainty that no matter what we’re discussing, only about half the population will succeed at being above average.

The one thing that absolutely will not happen is that no matter how hard anyone tries, only about half the strivers will outperform.

The thing to remember is that no matter how much any or all of them try, there will never be much more than about 50% who are better than average. The Behavioural Economics breakthroughs of the past couple of generations have laid bare what the small library of self-help books has inadvertently created: a western world awash in confident snowflakes who go about their business thinking that if they just try a little harder, they can accomplish just about anything. By definition, about half the people in any given sample will be below average.

Unfortunately, it isn’t possible that we’re all right. Believing in yourself is just human nature. This tendency has become known as the “Lake Wobegon Effect” as a hat tip to Garrison Keillor’s imaginary land where everyone is above average. Are you an above average driver? What about love making? Are you better than most, worse than most or about average? Surveys have shown over and over that people tend to overestimate their own abilities.

0 kommentar(er)

0 kommentar(er)